Interest-only: Can I just not pay off my loan?

With the rates this high, our loans are becoming much more expensive. There is a way to make it cheaper: by just not paying off the loan. But is this a smart thing to do? What are the benefits, what are the risks? Am I eligible for the interest only (aflossingsvrije) mortgage?

To get to the answers we first need to understand a bit more how the Authority of Financial Market works. The Authority Financial Market (AFM) keeps an oversight on the credit of the general public. People should not be allowed to borrow more than they can actually afford (looking at you house crisis U.S. 2008). One way to do this, is to compare the credit weight of a loan, and the maximum credit allowance. In simple terms: how much does this cost and how much can you afford.

How much it costs is expressed in annuity monthly cost. A €300.000 loan with 4%, in a 30 year span costs €1.432,50 per month in annuity. This is IF the interest is deductible. If for some reason your interest is not deductible, you are left with less money per month. Therefore the loan weighs more. The €300.000 would then weigh for €1.850 per month. This is not what it costs, but it’s what the banks have to test with!

Same principle applies if you switch to linear. The same loan linear would cost you €1.833 per month, but if the interest is deductible, the bank will only test it as if it costs €1.432,50 per month. Now it gets crazy: lets make the loan interest-only. It will only cost €1.000 per month, BUT the bank will see it as €1.850. Next up is how much are you allowed to spend on your house? With an income of €65.000/year you are allowed to spend €1.462,50 per month on your house. And here is where it gets crazy.

The bank will allow you to pay €1.833 per month, if you take out a linear loan, but they will NOT allow you to pay €1.000, because it is an interest-only non-deductible loan. what are the pros and cons?

The only pro of this type of mortgage is to lower your monthly expense. It would work for those who have many other bigger bills (kids, health conditions, too many holiday plans) or if you know a way to earn more % on your money, than it costs. Why pay off a 4% loan, if I can use that money to earn 7% on it…

There are multiple cons. Most of the banks charge a higher interest rate on interest-only mortgages. The argument is that, there is a bigger risk on your loan because you’re not paying off your debt. But also they do it simply because they can. The loan gets cheaper so a higher rate is not always that noticeable. Another con is that you will still be left with a debt at the end of your contract. You will either have to re-finance, or pay off the entire amount at once, by selling the house. The effect of not paying it off, also means that the monthly amount of interest will always stay the same (for the duration of the fixed period). With annuity or linear, each month you’ll pay lesser and lesser of interest. So the overall interest is lower.

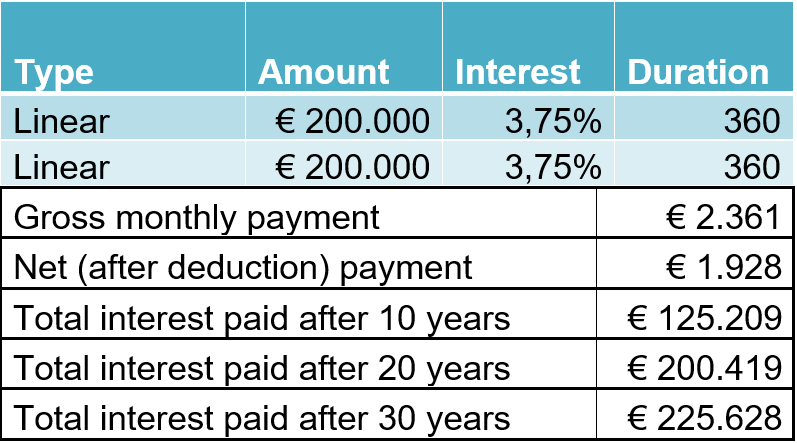

I will show you an example of a €400.000 mortgage, interest rate is 3,75%, fixed for 30 years. In the first example we have the loan fully linear, in the second example we take 50% annuity, and 50% interest only. Fully linear:

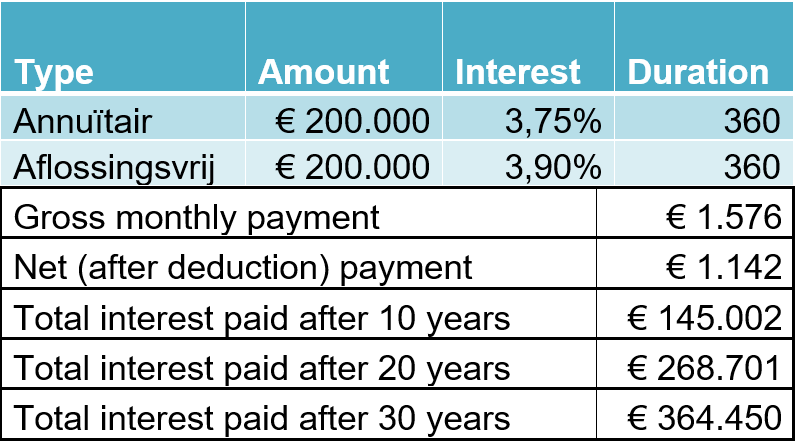

And 50/50:

You will notice: paying off, pays off. A €20.000 difference in interest. But how would it be different, had we traded that money in stocks? The difference in monthly payment is €785. Imagine we put that money into a trading account, each month. The monthly profit is 1/12th of 4%. In 10 years’ time you would have invested €94.200. The value of your portfolio would be €115.976. A profit of €21.776. The more secure you are about your profits, the more attractive it becomes to just invest instead of pay off. However: paying off is always a guaranteed profit (if you consider saving money is the same as a profit).