Increasing interests: short term low or long term high?

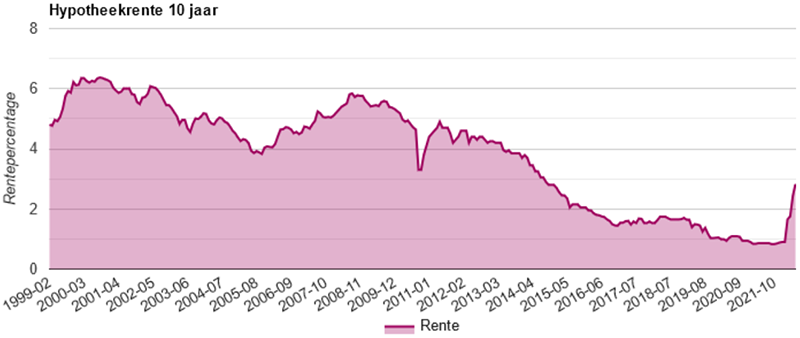

We are dealing with a period of increasing interest rates. A number of factors come in to play, like the inflation as a result of years of low interest rates, the war in Ukraine and the complicated agenda of the European central bank. Where should we look, to know exactly which rate to pick?

There is no best answer to pick an interest. In the past 40 years, the 10 years fixed interest has been lower than 4% for only 7 years (the last 7 years). And we do not see any upcoming event that will lower the rates again.

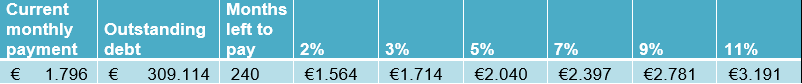

It’s more important to ask yourself, what can I afford right now, and what could I afford in 10 years? If you were to pick a 10 year interest rate, you will have to pick again the rate in 10 years, not knowing what it might be. Let’s look at the example of Loes and Rik, and her €400.000 mortgage. Loes has a yearly income of €50.000, and Rik earns €45.000 annually. The €400.000 mortgage costs €1.796 per month, based on 3,5% annuity. Right now, Loes and Rick are fine paying this much. How much would it be in 10 years? A big part will be paid off, and then they’ll have to pick another interest rate for the next period. The loan still has 20 years of payments left. How would this look like? In the table below, you’ll see possible interest rates in 10 years, with their corresponding monthly payments.

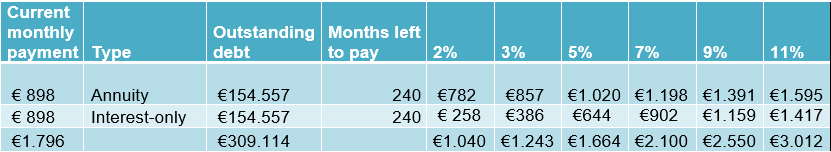

How do you see your income developing in the coming 10 years? Would you like to cut hours? Make many promotions? A loan this big has big implications on your way of life. It would also be possible to make a part of the loan interest-only. This way you don’t pay instalments, but just interest. However for this you’ll need to already split the loanparts at the moment of the mortgage application! Lets look at the same example, but now we have split up the loan in two parts, with one of them we’ll change the interest-only after 10 years.

With a split in loanparts, you can opt for a lower 10 years fixed interest rate, and still have a back-up plan in case the rates have gone up. Check out the blog about interest-only, for the pros and cons about this type of mortgage.